Embark on a journey in pursuit of financial freedom, where abundance knows no bounds. This isn't just about accumulating assets; it's about achieving a state with true independence. It's the ability to control your own choices, free from the limitations of financial obligation. By embracing a mindset toward abundance and utilizing smart financial strategies, you can pave the path on lasting prosperity.

- Initiate by establishing your monetary goals. What does financial freedom signify to you? Once you have a clear vision, create a strategy that aligns with your aspirations.

- Diversify your investments over different asset classes to mitigate risk and amplify potential profits.

- Regularly learn your financial awareness by reading books, articles, and seeking with experts.

Mastering Your Money

Achieving financial success is a journey that requires careful planning and discipline. It's about understanding your economic situation, setting clear goals, and making smart decisions with your resources. A solid financial foundation enables you to attain your dreams, whether it's purchasing a home, securing early retirement, or simply existing with peace of mind.

Let's by outlining some key steps to assist you on your path to financial mastery:

- Develop a comprehensive budget that tracks your revenue and outgoings.

- Determine areas where you can cut back spending.

- Cultivate an emergency fund to absorb unexpected expenses.

- Diversify your savings wisely to increase your wealth over time.

- Consult professional financial advice when needed.

Remember, mastering your money is a continuous endeavor. By implementing these principles and cultivating healthy financial habits, you can secure lasting financial freedom.

Approaches for Growing Your Portfolio

Embarking on the journey of investing can feel daunting, although with the right strategies, you can foster a thriving portfolio. A cornerstone of successful investing is {diversification|, spreading your assets across various asset classes such as stocks, bonds, and real estate. This mitigates risk by limiting the impact of any individual investment's performance. Another key principle is chronic thinking. The market experiences swings, but over time, a well-diversified portfolio tends to grow in value.

- Conduct thorough research before making any investment decisions.

- Remain informed about market trends and economic indicators.

- Assess your portfolio frequently to ensure it matches with your financial goals.

Remember, investing is a marathon, not a sprint. By adhering to sound principles and remaining patient, you can achieve your financial aspirations.

Debt Decoded: How to Eliminate and Manage It Effectively

Feeling burdened by debt? You're not alone. A large number of people struggle with controlling their finances, but the key to financial freedom lies in understanding and effectively combating your debt.

The first step is analyzing your current financial situation. Create a comprehensive budget that lists your income and expenses. This will provide you exactly where your money is going and highlight areas where you can trim spending.

Next, prioritize your debts from highest to lowest interest rate. Focus on settling the most expensive debt first using methods like the debt reduction technique. Consider options for merging your debts into a single loan with a lower interest rate. This can simplify payments and potentially save you money in the long run.

Remember, persistence is key.

Cultivating healthy financial habits takes time and dedication. Seek guidance from a financial advisor if needed. By implementing proactive steps to reduce your debt, you can attain financial stability and embrace the freedom to achieve your goals.

Financial Freedom Starts Here: Budgeting 101

Taking control of your finances may seem overwhelming. It all starts with creating a solid budget. A budget enables you track your income and expenses, giving you detailed picture of where your money is going.

- Start by identifying your sources of income.

- Afterward, compile all your monthly expenses.

- Contrast your income with your spending to determine where you are at.

Once you know your financial situation, you can start creating changes to reduce expenses. Consider areas where you could trim costs. Be realistic when establishing your budget. Keep in mind that budgeting is a ongoing effort and needs to be flexible to your changing needs.

The Money Mindset: Cultivating a Wealth-Building Attitude

Achieving financial read more abundance isn't solely about methods. It starts with cultivating the right attitude. A wealth-building perspective empowers you to make intelligent financial decisions, break free from limiting beliefs, and attract abundance.

First, reframe any negative assumptions you have about money. Do you feel that money is scarce? Or do you see it as a resource for growth and joy?

Transform your perception of wealth. It's not just about the quantity of money you have, but also about the purpose it brings to your life.

Cultivate a abundance mindset by concentrating on what you can influence.

Celebrate your successes, no matter how small.

And most importantly, believe in your ability to create the financial future you desire.

Jonathan Taylor Thomas Then & Now!

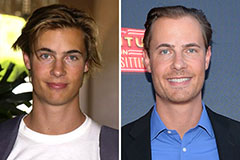

Jonathan Taylor Thomas Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Jane Carrey Then & Now!

Jane Carrey Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!